Japan has known as the gateway into the Asia market with a market-oriented economy ideal for market entry, and ventures, and full of opportunities. Companies consider Japan as a beneficial market to enter for the sake of enhancing their brand image before expanding business to the Asia and global markets because Japan has high-quality standards and stable laws. Also, global entrepreneurs consider Japan as the best place for test marketing of their products and services before commercialization because the purchasing power of Japanese consumers is high.

Japan is an innovation powerhouse, and many recent global technology revolutions started in this country.

Nevertheless, breaking into the Japanese market claims different barriers and difficulties for foreign companies and entrepreneurs. To penetrate this lucrative market, companies should plan suitable market entry strategies considering success in their journey.

Any global company that intends to enter the Japanese market needs to have an accurate market entry strategy plan and measure all scops of entering procedures to succeed in this market. Global entrepreneurs regarding Japan’s market entry need to align their strategy, products, and services to the Japanese market conditions, consumer needs, and regulations. Preparing properly before entering the Japanese market is a key to success. Therefore, Preparation Strategies are essential for companies to unlock Japanese market secrets in terms of implementing a successful market entry plan and disrupting this market.

Subscribe to our Newsletter

Preparation strategies are the steps companies need to take before starting entry into the Japanese market. These strategies are necessary for any company, and they are blueprints for global companies to ease their business expansion in the Japanese market. In this blog, we discuss two important practical Preparation Strategies required by global companies in entering the Japanese market. The first one is Market research, and industry analysis strategy, and the second is Localization and Adaptation Strategy.

Market Research and Industry Analyses Strategy:

One of the important steps in entering the Japanese market is to conduct comprehensive market research. Market research and industry analyses should be mandatory for foreign companies as the main preparation strategy in their market entry procedures. But what is the reason behind the necessity of market research and industry analysis?

The quick answer is Japanese market represents a complicated market environment and industry trends shift frequently. Companies need to conduct comprehensive market research to assess Japan's market micro and macro environmental conditions. In addition, failure to properly conduct market research has irreparable consequences for companies such as increasing costs, losing time, and missing opportunities.

Here is another question…

After conducting market research, what factors should companies identify?

After conducting market research, companies should realize different factors about the Japanese market such as:

Japanese customers’ behavior

Japanese consumers are demanding and understanding their needs is very important to succeed in entering the Japanese market. They are well known as smart and careful buyers, and they consider high-quality standards when they are purchasing any goods and services. Market research helps global companies to identify their target customers' behavior and needs, key buying factors to purchase their services or products, and market demands for their products and services in the Japanese market. Furthermore, considering the B2B partners, market research helps companies to realize Japanese distributors, importers, and B2B buyers’ business characteristics and the way of doing business with them. An example of a company that didn’t research Japanese consumers' behavior properly and failed is IKEA in 1986 which didn’t search about the sizes of Japanese houses at the early stages of market entry and provided its products in the same size as their home country. However, IKEA did a great job back in 2006 in market research and identifying Japanese customers' behavior after the first time failing in entry and came up with an excellent customer-centric strategy in considering the local standard of living and maintaining correspondent prices and quality.

Japanese market regulation

Japan has strict regulations and laws in the importing fields, selling products and services, and company establishment. Market research is mandatory for companies who intend to enter the Japanese market to identify Japanese law. Minoring the Japanese regulations claim irrecoverable consequences for foreign companies and are one of the main reasons for failure in the market entry process. Different companies failed in Japan because they didn’t apply proper market research in their market entry strategy. For instance, Uber failed at the beginning of its entry into the Japanese market because it didn't identify how transportation laws were perceived in the market. Uber first tested the Japanese market with their service called “Ride Share” which has been illegal to ride with someone without a business license and permit in this country.

Japanese Sales and Distribution channels

Sales and distribution channels are complex in the Japanese market and vary in different industries. Therefore, conducting market research helps companies to assess suitable distribution channels and sales strategies in market entry procedures. Distribution channels extend notably between consumer goods and industrial products. The Japanese business culture for doing business face-to-face and, loyalty in business relationships, nurture the supply chain system, however, the cost of this inefficient system exceeds end-users in the final price of the product.

Competitors analyses

Japanese competitors are the major barrier to Japan's market entry and understanding their business models, promotion, and marketing channels helps foreign companies to identify the entry strategy, level of competition, and ways to differentiate themselves from Japanese competitors. Although, comprehensive market research helps companies to identify the proper strategy to compete with Japanese competitors. One of the good examples of companies that did their research properly before launching in Japan is Netflix. They identified their competitors' business model, and Japanese consumers' behaviors excellently. According to the GEM Partners in February 2022, Netflix was the leading subscription video-on-demand service in Japan in 2021.

Product and price feasibility

Market research helps foreign companies to realize their product and service viability to the Japanese market. The quality of your product or service is the most important key to success in the Japanese market. Also, the quality of customer care and after-sales service is the reason to maintain your reputation among your customers in Japan. Even a minor change in the quality of your products or after-sales service motivates customers to consider other service providers or product suppliers over you. Market research helps global companies to realize how to adapt their products and services that align with Japanese consumer needs.

Furthermore, market research is beneficial for foreign companies in Japan's market entry because they identify their price feasibility for the Japanese market and the best price strategy to compete in this lucrative market. Pricing is one of the important key buying factors (KBFs) for Japanese consumers. An example of a company that didn’t properly study the pricing and purchasing behavior of Japanese consumers and failed is Walmart. Walmart thought they could disrupt the market by offering low prices to Japanese consumers same as the strategy that they have been implementing in the US market, but they were wrong because Japanese end-users purchase products and services at any price that delivers value to them. Also, they prefer to purchase low-priced products as a treasure of searching between different supermarkets and choosing the products they need.

Market research is important for foreign companies to identify suitable market entry strategies.

It is better to hire a Japanese local market research company or a Japan-based market entry consultant in terms of accessing to real data analyses.

Localization and Adaptation Strategy

Communication drives business relationships in Japan. Gaining Japanese consumers' trust is a big hurdle for global companies in Japan's market entry. Localizing your brand and marketing message are important factors to build trust and leading sales in the Japanese market. After conducting comprehensive market research and identifying the consumers’ insight, a localization strategy is necessary for foreign companies to prepare properly for entering the Japanese market.

What is Localization:

Localization is proposing your final product to consumers who think a local company made it from scratch with a unique value for them.

Quick question: what are the localization strategies in the Japanese market?

Website and marketing material localization

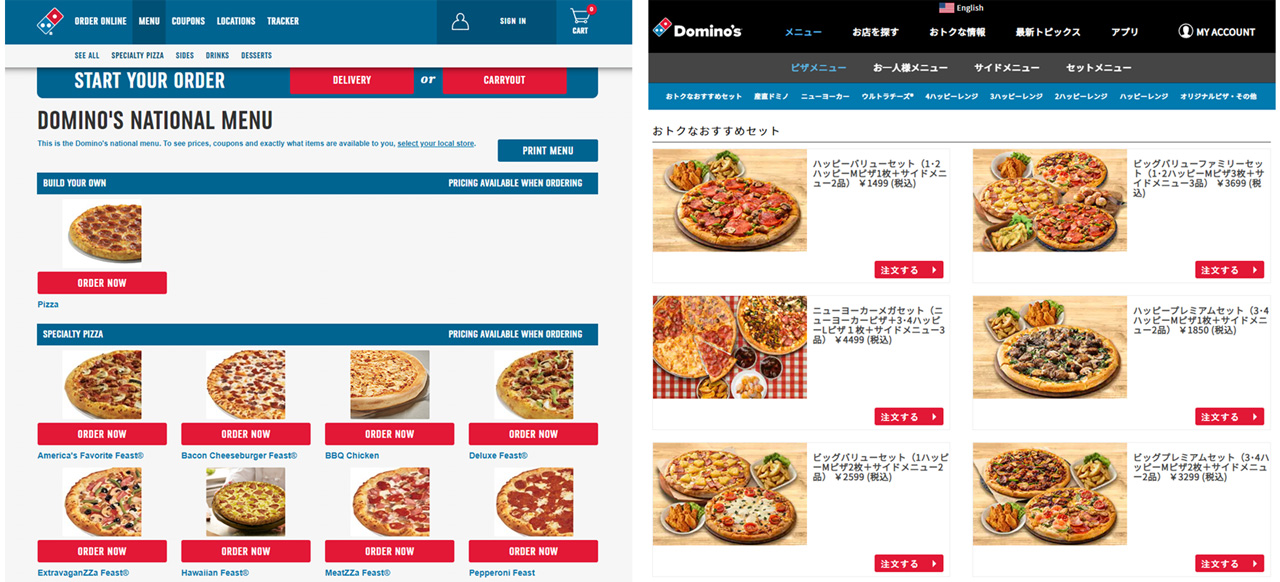

Localize your website, social media channels and marketing materials. Share as much as possible information about your products and services on them in Japanese language because, Japanese consumers would like to know about what they may purchase and Japanese content build trust between your product and them. The information should convey the value of your products or services to Japanese consumers. It is better to hire a Japanese localization specialist. Localization shouldn’t be confused with word-to-word translation. The content needs to be tailored so that it is relevant and makes sense to the Japanese audience. In other words, it should be localized to meet local Japanese market situations and needs. We can consider Domino’s as a good website localization example. Comparing the Menu section of their website in Japan which is wordier than the Western version is one of the important factors in the adaptation strategy because Japanese consumers seek information when they purchase a product.

Product and Packaging Localization:

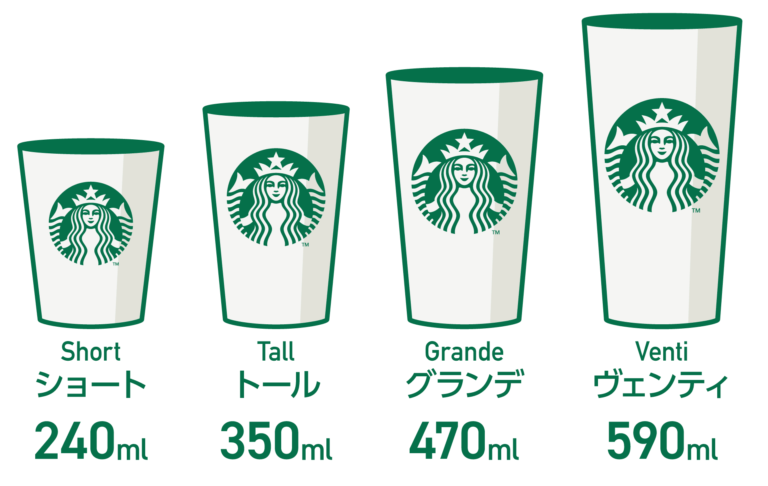

- Product size, and contents

The size of products in Japan is different from the product size that you are selling in your country. Japanese consumers' preferable product size is smaller than in other parts of the world. The packaging size in Japan is smaller than in other countries as well. For example, shelves size in supermarkets in Japan have specific standards, and the size of the product should fit in it, therefore considering the size of the packaging is very important, on the other hand, Japanese houses don’t have that much space for a large product, and consumers opt to purchase products that suit to their place of living space. Furthermore, in the food and beverage industry understanding the flavors that Japanese consumers prefer and applying them to your products is a competitive advantage. Therefore, companies need to identify the way to adapt their products before entry.

- Packaging design, and materials

Your packaging design should fulfill the Japanese consumers’ demands, and behavior. Also, the quality of packaging materials plays important role in consumers buying decision-making. Japanese consumers pay attention a lot to the design and the material used in the package at the time of purchase. The information about your products such as the way of use and ingredients should be written on both packages and products in the Japanese language.

Let’s look at two global brands Preparation Strategy who have a successful Japan market entry journey.

Kit Kat has done an excellent job in market research and localization strategy in the Japanese market. Kit Kat Japan offers a group of products that are available in the Japanese market.

Kit Kat did a great job in market research to identify the Japanese consumer’s insight. Furthermore, they did a fantastic product localization strategy from packaging size and design to product contents by offering different flavors. For example, Kit Kat offers green tea-flavored Matcha chocolate specific to the Japanese market. Also, this product is a trend in the European market. Nestle localized universal design in its products that were introduced to the Japanese market.

The most important factor in Japan market entry is companies need to think globally and act locally.

Preparation strategies are the starting point for any company in the Japanese maket entry. Preparation strategies are necessary for companies to assess their target market accurately and localize their products and services to fulfill the needs of their customers.

Also, these strategies help companies to analyze and identify the best possible market entry strategy to break into the Japanese market.

However, conducting practical market analysis and identifying the best Japanese localization strategy should be applied in a proper direction. A lot of companies failed in the market entry to Japan because they didn’t conduct the appropriate market research strategy for the Japanese market, or they were on the wrong path in the adaptation of their products and services for this competitive market. Preparation strategies should plan and applied appropriately, otherwise would be the reason for failure in market entry.

We Are Here for You

DGC’s Japan market entry experts help you to conduct practical Japan market research, analyze market data, and support you in identifying suitable localization strategies to become ready to break into the Japanese market.