Effective Market Entry Strategies for the Japanese Food and Beverage Industry

Exploring Productive Approaches to Enter and Establish a Presence in the Japanese Food and Beverage Market.

Are you interested in tapping into the lucrative Japanese food and beverage market? Developing effective market entry strategies is essential for successfully entering and establishing your presence in this thriving industry. In this blog post, we will explore key approaches for market entry in the Japanese market and provide insights into market size, market share, trends, success and failure stories of foreign companies.

Let’s dive into the world of the Japanese food and beverage industry.

Market Size and Market Share in the Japanese Food and Beverage Industry

The Japanese food and beverage import market is a significant opportunity for foreign suppliers. In 2022, the market size for food and beverage imports in Japan reached an impressive $96.4 billion. This demonstrates the potential for growth and profitability for companies looking to enter this market.

When it comes to market share, imported food and beverages hold a substantial portion in the Japanese market. Imported products accounted for approximately 15% of the total food and beverage consumption in Japan, reflecting a strong demand for international offerings.

Trends in the Japanese Food and Beverage Market

Understanding the current trends in the Japanese market is crucial for successful market entry. Here are some key trends shaping the food and beverage industry in Japan:

Health and Wellness:

Japanese consumers are increasingly focused on health and wellness. There is a rising demand for products that promote well-being, such as functional foods, organic options, and items with natural ingredients.

Convenience and On-the-go Products:

Busy lifestyles have driven the demand for convenient and on-the-go food and beverage options. Ready-to-eat meals, portable snacks, and individually portioned products are gaining popularity.

Sustainability and Local Sourcing:

Environmental consciousness and support for local businesses are key factors influencing consumer choices. Sustainable packaging, eco-friendly practices, and locally sourced ingredients are highly valued.

Subscribe to our Newsletter

Several foreign companies have achieved remarkable success in the Japanese market. Here is a notable example:

Heineken

The Dutch brewing company, Heineken, successfully established its presence in Japan.

Craft Beer Trend

Heineken recognized the growing popularity of craft beer in Japan. As consumers sought unique and flavorful beer options, Heineken introduced a range of craft-style beers to cater to this demand. By capitalizing on the craft beer trend, Heineken positioned itself as a brand that offered premium and artisanal beer choices.

Product Innovation

Heineken focused on product innovation tailored to the Japanese market. They developed new beer flavors and variations specifically designed to appeal to local tastes. This included limited-edition releases, seasonal brews, and collaborations with local breweries. By continuously introducing new and exciting products, Heineken captured the attention and loyalty of Japanese consumers.

Brand Image and Marketing

Heineken invested in building a strong brand image in Japan. They positioned themselves as a premium and sophisticated beer brand, targeting consumers who appreciated quality and refined taste. Heineken’s marketing campaigns emphasized the brand’s heritage, craftsmanship, and global appeal, aligning with the aspirations of Japanese consumers.

Strategic Partnerships and Distribution

Heineken formed strategic partnerships with local distributors to ensure effective and widespread distribution of their products. By collaborating with established distribution networks, Heineken secured placement in supermarkets, convenience stores, bars, and restaurants throughout Japan. This extensive reach allowed them to make their products easily accessible to consumers across the country.

Engaging Consumer Experiences

Heineken focused on creating engaging experiences for Japanese consumers. They actively participated in beer festivals, sponsored events, and organized promotional activities that allowed consumers to interact with the brand directly. These experiential initiatives helped foster a sense of connection and loyalty among consumers.

Adapting to Local Customs

Heineken made efforts to understand and respect local customs and traditions in Japan. They integrated Japanese elements into their marketing campaigns and packaging designs, demonstrating cultural sensitivity and appealing to consumers’ sense of familiarity and pride.

By leveraging the craft beer trend, product innovation, strong brand image, strategic partnerships, engaging experiences, and cultural adaptation, Heineken successfully positioned itself as a prominent player in the Japanese beer market. These factors contributed to their continued growth and success in capturing the preferences and loyalty of Japanese consumers.

Understanding the challenges faced by foreign companies in the Japanese market is crucial for developing effective market entry strategies. Here are a couple of notable failure stories:

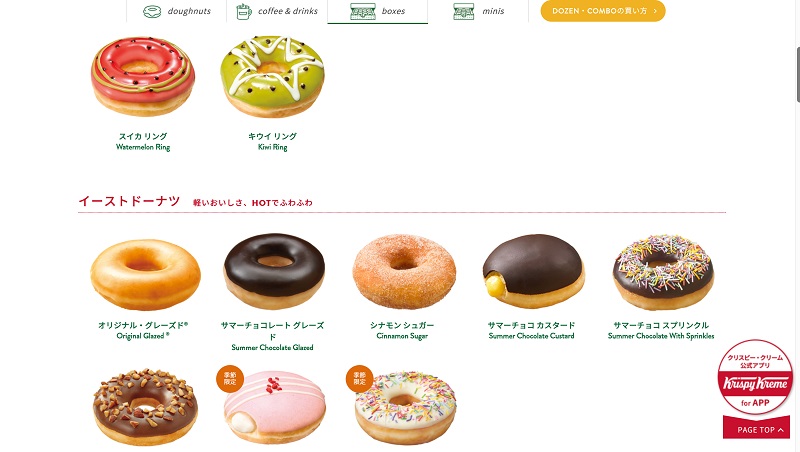

Krispy Kreme

Krispy Kreme, the American doughnut chain, faced challenges with its entry into the Japanese market. Despite initial excitement and long lines at its stores, Krispy Kreme struggled to sustain its success in Japan. One of the key factors contributing to its failure was the misjudgment of consumer demand and preferences. Krispy Kreme primarily offered glazed and sugary doughnuts, which did not align well with the more subdued and subtle flavors preferred by Japanese consumers. Additionally, the pricing strategy of premium doughnuts in a market where doughnuts are typically seen as affordable treats also hindered its appeal. These factors, combined with increased competition from local doughnut chains, led to a decline in sales and the closure of many Krispy Kreme stores in Japan for example the first store in Shinjuku, Minami Shinjuku closed on January 3, 2017 (Read more)

Kellogg’s Cereal

Kellogg’s, the American multinational food manufacturing company, faced challenges in the Japanese market with its cereal products. Despite being a popular choice in many markets worldwide, Kellogg’s cereal initially struggled to gain traction in Japan. The traditional Japanese breakfast typically consists of rice, miso soup, and other savory items, which made the concept of sweet cereal less appealing to Japanese consumers. Kellogg’s failed to effectively adapt their cereal offerings to suit local tastes and preferences, resulting in limited consumer interest and market share.

This failure highlights the importance of understanding and adapting to local preferences and cultural habits when introducing food and beverage products in a new market like Japan.

Succeeding as a foreign brand in Japan’s food and beverage market requires focusing on crucial factors that contribute to your success:

1. Cultural Understanding

Respect Japanese traditions and preferences. Tailor product offerings, marketing, and communication styles accordingly.

2. Localization and Customization

Adapt products to suit local tastes, flavor profiles, and dietary habits of Japanese consumers.

3. High Quality and Safety

Meet the high expectations for product quality and safety. Highlight certifications and transparent sourcing practices.

4. Strong Distribution Networks

Collaborate with reliable local distributors and retailers to increase market accessibility.

5. Strategic Partnerships

Form alliances with local businesses for valuable insights and access to networks.

6. Effective Marketing and Branding

Develop compelling messaging and targeted campaigns through various channels.

7. Embrace Innovation and Trends

Stay updated on market trends and consumer preferences to innovate and stand out.

8. Commitment to Long-Term Relationships

Focus on building trust, reliability, and customer satisfaction for sustained success.

By considering and implementing these key success factors, foreign brands can position themselves for success in the Japanese food and beverage market. It’s important to conduct thorough Japan market research, understand consumer preferences, and continuously adapt your strategies to meet the evolving needs of the market.

Partnering with a knowledgeable market entry consultant like DGC greatly enhances success in the Japanese food and beverage market. Our exceptional UMAMI Development service for foreign suppliers ensures a tailored market entry strategy, understanding of consumer preferences, and effective distribution channels. Seize opportunities in this dynamic market with DGC’s guidance and establish a strong presence in Japan’s food and beverage industry.