Cracking Japan’s Retail Landscape in 2025

Opportunities, Challenges, and Strategic Entry Solutions

Introduction

Japan, the world’s third-largest economy, presents a lucrative yet complex retail market for international brands. With a retail market size projected to reach USD 1.78 trillion in 2024, and an anticipated growth to USD 2.01 trillion by 2033, Japan offers immense opportunities for businesses that can adeptly navigate its unique consumer behaviors, regulatory landscape, and competitive dynamics.

At Driven Global Consulting (DGC), we specialize in guiding foreign companies through the intricacies of Japan’s retail sector. This comprehensive guide explores the current market landscape, emerging trends, challenges, success stories, and strategic approaches to successful market entry.

Japan’s retail market remains one of the most advanced in the world. It is defined by a well-established consumer base, technological innovation, and an intricate balance of tradition and modernity. In 2024, the total retail sales were estimated at USD 1.78 trillion, and they are expected to grow steadily to reach USD 2.01 trillion by 2033. This growth is driven largely by aging demographics, technological advancements, and an evolving e-commerce sector.

E-commerce is a particularly high-growth area, expected to grow by 7.7% in 2025 alone, reaching a market value of USD 206.8 billion. This surge is powered by mobile commerce and the increasing adoption of cross-border platforms. Meanwhile, Japan’s convenience store sector continues to thrive, with over 56,000 stores generating upwards of USD 77 billion annually.

Japan’s consumer demographics add to the market’s complexity. Nearly 30% of the population is aged 65 or older, holding more than half the nation’s wealth. Simultaneously, younger generations like Millennials and Gen Z are driving trends in sustainability, wellness, and digital consumption

Technological Integration in Retail

Japan leads in merging retail with advanced technology. Innovations such as robotic store assistants and AI-powered avatars have started appearing in stores like 7-Eleven and Lawson. These technologies help address labor shortages while improving the customer experience. Robots can help navigate product locations, while multilingual avatars can interact with international shoppers.

E-commerce Expansion

The growth in Japan’s e-commerce landscape is being accelerated by mobile-first strategies. With high smartphone penetration and improved internet infrastructure like 5G, consumers are increasingly shopping online. Moreover, convenience stores, or ‘konbini’, play a pivotal role by acting as pick-up and payment points for e-commerce purchases, even supporting cash payments—a major benefit in a society that still values cash transactions.+

Sustainability and Health Consciousness

Consumer preference is shifting toward environmentally friendly and health-focused products. The food and beverage industry is evolving to offer functional and elder-targeted food solutions. In the beauty sector, there is growing demand for anti-aging and clean-label skincare products. Japanese consumers expect transparency and functionality, especially in wellness categories.

Rise of Oshikatsu Culture

A significant cultural trend shaping retail consumption is “Oshikatsu,” which refers to the active support of favorite characters, celebrities, or franchises. With nearly 14 million people engaged in such activities and an annual spend of over USD 23 billion, this phenomenon contributes more than 2% to the country’s retail GDP. Brands that align with anime, pop culture, or mascots are tapping into a passionate, loyal customer base.

Super Bundling of Subscriptions

Consumers are increasingly seeking value and convenience through bundled digital subscriptions. Platforms that offer multiple services—from streaming to gaming to e-learning—in a single monthly fee are gaining traction. For retail brands, this opens opportunities for strategic alliances and loyalty programs embedded within subscription ecosystems.

Tourism Recovery and Retail Impact

Japan’s tourism sector, severely impacted by the pandemic, has rebounded sharply since borders reopened in late 2022. In 2024 alone, Japan welcomed over 30 million international tourists, with projections for 2025 exceeding 34 million.

Retail is a major beneficiary of tourism, especially in urban centers like Tokyo, Osaka, and Kyoto. Duty-free shops, department stores, and luxury brands are capitalizing on increased tourist traffic by offering multilingual staff, tax-free services, and airport delivery options.

K-beauty, J-beauty, health supplements, electronics, and souvenirs are among the top-selling categories. Retailers that tailor in-store experiences to international travelers and integrate digital tax-free systems are seeing above-average sales growth.

For brands considering market entry, tourism-focused strategies—such as placing flagship outlets in tourist districts or collaborating with inbound travel platforms—offer high visibility and fast traction.

Subscribe to our Newsletter

Entering the Japanese retail market offers numerous advantages. Japan has high purchasing power, advanced infrastructure, and a consumer base that values quality and brand integrity. Urban density, particularly in cities like Tokyo and Osaka, allows for concentrated marketing and sales efforts. Moreover, success in Japan can serve as a badge of honor and a launchpad into other Asian markets.

However, Japan’s market is also notoriously difficult to penetrate. Cultural and language barriers can hamper communication and brand alignment. Regulatory frameworks are strict and often opaque, particularly in industries like food, cosmetics, and health supplements. Japanese consumers are highly discerning and slow to adopt new brands, requiring patience and long-term investment. Brands must also overcome the dominance of established domestic players and meet elevated expectations for service, packaging, and product quality.

Cultural sensitivity is a prerequisite for success in Japan. Brands that fail to localize their messaging or overlook consumer preferences are likely to be ignored. Beyond language, this includes aesthetic considerations, etiquette, and expectations for modesty or humility in brand presentation.

Regulatory compliance is another critical hurdle. Japan has some of the world’s most rigorous standards for product safety, labeling, and documentation—especially for consumables and cosmetics. Navigating this landscape requires local expertise and careful planning.

Additionally, price positioning is delicate. Japanese consumers are willing to pay a premium for quality but expect products to deliver clear functional value. Brands must carefully balance price, presentation, and product efficacy.

Several global brands have managed to successfully enter and grow within the Japanese retail landscape.

Lululemon, the Canadian athletic apparel company, leveraged Tokyo’s fitness culture and interest in premium, functional fashion. The brand launched localized campaigns and community-based events to foster a sense of lifestyle connection.

SHEIN, the Chinese e-commerce giant, found immense popularity among Gen Z consumers in Japan through affordable pricing, trend-savvy designs, and aggressive social media marketing, particularly on TikTok and Instagram.

Rituals Cosmetics, a premium wellness brand from the Netherlands, entered Japan in 2024 with a Zen-inspired store concept, elegant gift packaging, and storytelling around wellness and mindfulness. Their alignment with Japanese aesthetics and cultural gift-giving traditions led to strong early adoption.

Entering Japan successfully requires a combination of strategic planning and localized execution.

Conducting in-depth market research is the first step. Brands must analyze consumer trends, segment preferences, price sensitivity, and competitor performance. This provides a roadmap for positioning and avoids costly missteps.

Localization of products and messaging is crucial. This involves translating not just the language, but the emotional tone, design, and value proposition. Packaging often needs to reflect minimalism, clarity, and purpose. Cultural aesthetics should be embedded in both the physical product and digital communication.

Developing an omnichannel strategy that integrates e-commerce with retail stores can maximize consumer access. Japan remains a society where physical retail experiences are important. Pop-up stores, department store counters, and flagship boutiques help build credibility and trust.

Building strategic partnerships with local distributors, regulatory agencies, and logistics providers ensures that supply chains are compliant, efficient, and well-connected. This is particularly important for sectors involving health, food, or technology.

Navigating regulatory compliance requires early-stage planning with legal experts familiar with Japanese import rules, product classifications, and labeling requirements. Product approval and FOSHU, JPMA, or HACCP certifications may be necessary.

Building brand loyalty takes time. Initiatives like limited-edition products, personalized services, and engagement with local influencers can help build a loyal customer base. Word-of-mouth, community involvement, and consistent after-sales service are also critical.

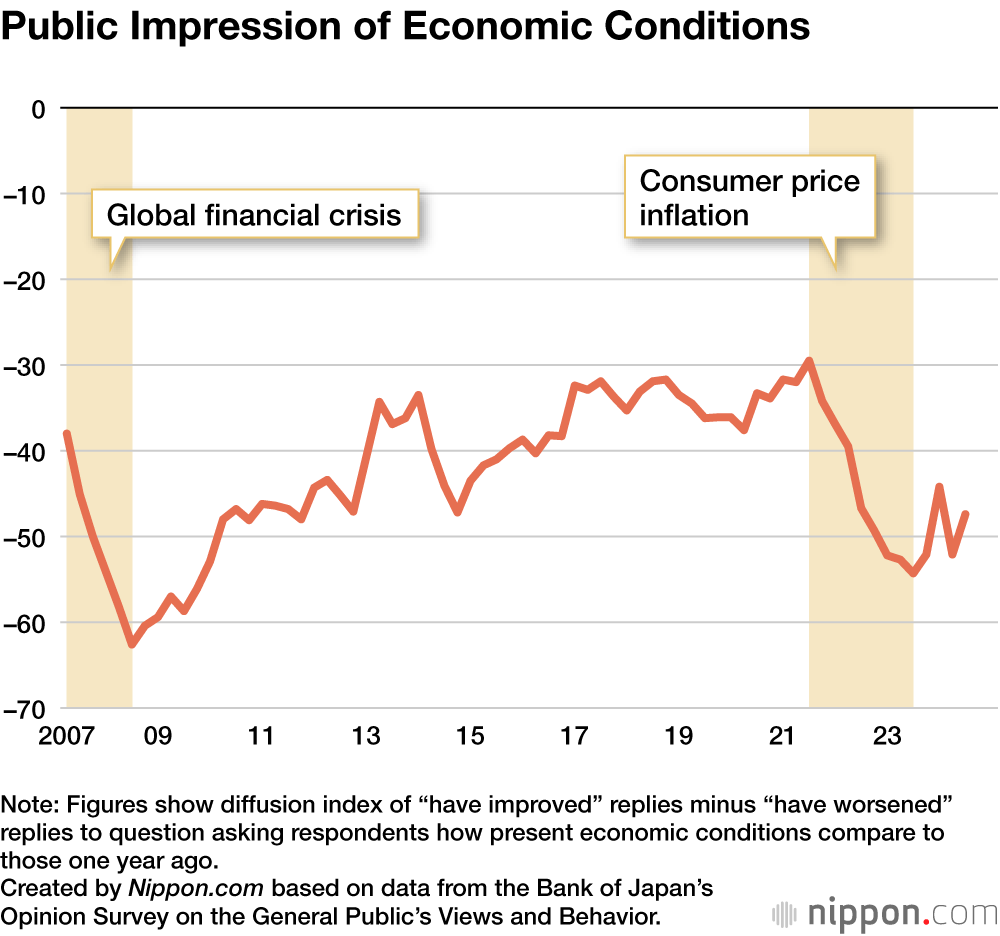

Japan’s economy in 2025 is defined by both cautious optimism and structural challenges. Core inflation stands at 3.2% YoY, mainly driven by food prices and rising utilities. Despite inflation, wages are also rising, with major retailers increasing pay in 2025 to retain talent, contributing to improved consumer purchasing power.

Retail sales grew by 3.9% YoY in January 2025, signaling stable consumer activity. However, the Bank of Japan remains conservative, keeping interest rates at 0.5% while monitoring inflation and a fragile global trade environment.

Labor shortages persist, especially in service and logistics sectors. In response, businesses are investing in robotics, multilingual AI, and automated systems—reflecting both necessity and innovation in Japan’s labor strategy.

At Driven Global Consulting (DGC), we offer foreign companies a complete suite of Japan market entry services. From early-stage market feasibility studies to long-term strategic implementation, we support every phase of your expansion.

Our services include:

- Tailored go-to-market strategies based on consumer insights

- Localization of branding, packaging, and marketing

- Regulatory compliance and certification guidance

- B2B matchmaking with retailers, distributors, and logistics partners

- E-commerce integration and performance optimization

- Ongoing strategic advisory and project management

With a multicultural Tokyo-based team, DGC understands both global brand expectations and Japanese market sensitivities. Our proven track record includes successful partnerships across health, wellness, beauty, fashion, food, and technology sectors.

Japan’s retail industry in 2025 presents unmatched potential for brands that are prepared to localize deeply, adapt to rigorous standards, and commit to long-term brand building. From innovative consumer tech to deep-rooted cultural traditions, Japan offers both a challenge and an opportunity.

If your brand is ready to expand into one of the most discerning and high-value consumer markets in the world, Driven Global Consulting (DGC) is your partner in strategy, execution, and sustained success.

Contact us today to start your journey into Japan.